The deadly coronavirus COVID-19 has thrown the oil and gas industry into complete disarray, but there are still a handful of oil and gas penny stocks seeing sizeable gains in their share price this week.

West Texas Intermediate oil futures to be delivered in May settled at -$37.60 per barrel on Monday, which marks the first negative close in history. This means that oil producers are running out of storage space amid collapsing energy demand and are now willing to pay buyers to take crude oil off their hands.

The price of a barrel of WTI crude turned positive and settled at $10.01 per barrel on Tuesday, but it is still down 84% from its recent high in January.

Despite the dire state of the oil and gas industry as of late, the following five oil and gas penny stocks are up over 20% today alone. Let’s take a look at why these companies are faring so well and which ones might be worth adding to your portfolio.

5 Oil and Gas Penny Stocks Surging: Torm PLC (NASDAQ:TRMD)

Torm PLC is at the top of the list of oil and gas penny stocks to watch this week after shooting up to a high of $48.86 on Tuesday.

Although the stock eventually settled back down to $12.60 by market close, it was still up 65.79% for the day.

So, what caused TRMD stock to skyrocket on Tuesday and experience an unprecedented trading volume of 881,168 shares?

The UK-based refined oil carrier didn’t release any news this week to garner any attention, nor have there been any positive updates surrounding the oil industry.

Apart from notifications of major holdings and ownership transactions, the last big news to come from Torm PLC was on March 3, when the company released its Q4 and full-year 2019 financial results.

In 2019, Torm has a revenue of $693 million and an EBITDA of $202 million, compared to 2018’s $635 million and $121 million, respectively. On top of that, the company finished the year with $1 billion in net asset value.

Of course, one reason Torm PLC could be getting attention is due to the lack of land storage space for oil, creating an interesting opportunity for companies that can offer floating oil storage.

As of March 13, Torm operated a fleet of about 80 vessels, all of which could potentially be targeted for additional oil storage.

In fact, with the world’s biggest oil storage company reaching its maximum capacity, it’s clear that oil companies are in desperate need of extra storage space.

Investors who are interested in oil and gas may want to consider investing in oil and gas stocks that could help solve the oversupply issue, which is where Torm PLC comes in.

Although Torm PLC is technically no longer considered an oil and gas penny stock at a price of $12.60, with a market cap of $930 million, it still falls in the small-cap range.

On Wednesday morning, TRMD stock retreated 28.5% to $8.94.

5 Oil and Gas Penny Stocks Surging: Gulfport Energy Corporation (NASDAQ:GPOR)

Independent natural gas and oil company Gulfport Energy Corp. comes in second on the list of oil and gas penny stocks that were on fire Tuesday.

Except for a surge on March 13, GPOR stock has remained under the $1 mark since releasing its Q4 and full-year financial results on February 27.

>> 5 Healthcare Penny Stocks Moving Higher

The company witnessed lower-than-expected Q4 2019 results, with fourth-quarter adjusted net earnings per share (EPS) of $0.05, missing the Zacks Consensus Estimate of $0.18. The bottom line was also below the EPS of $0.46 a share the previous year amid weaker year-over-year natural gas price realizations and higher costs.

What’s more, the company’s revenue of $281.2 million also fell short of the Zacks Consensus Estimate of $316 million.

On Tuesday, Gulfport’s share price increased by 82.69% to $1.42, although it’s unclear what gave the stock a boost.

GPOR also experienced a massive trading volume of 23,701,973 shares on April 21, which is well above its average daily volume of roughly three to seven million shares.

11 Wall Street analysts have issued ratings and price targets for Gulfport Energy, but the reviews are very mixed. The average 12-month price target for GPOR is $3.09, with a high price target of $7.00 and a low price target of $0.25, which suggests a possible upside of 117.11%.

On Wednesday afternoon by 12 pm EST, Gulfport Energy stock was up another 8.8% at $1.55.

5 Oil and Gas Penny Stocks Surging: SandRidge Energy Inc. (NYSE:SD)

Third on the list of oil and gas penny stocks that surged on April 21 is SandRidge Energy, an oil and natural gas exploration and production company headquartered in Oklahoma.

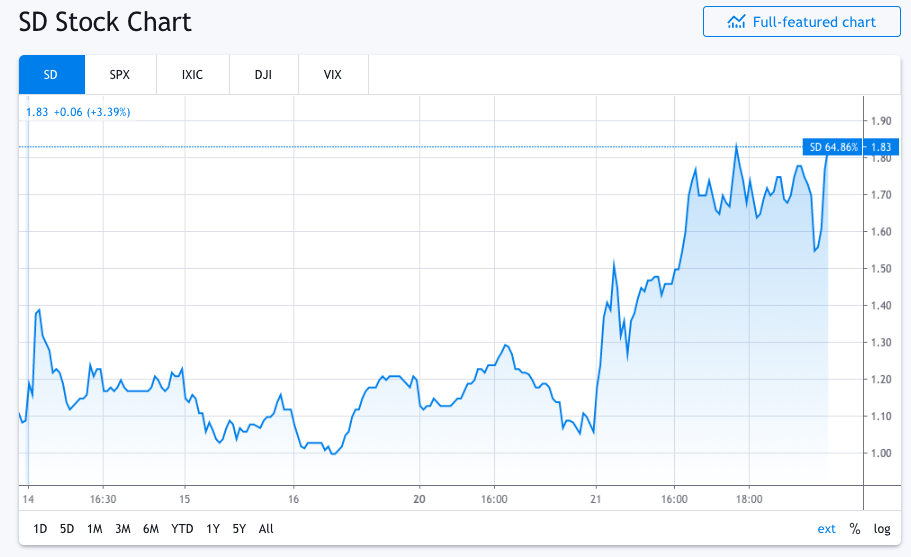

On Tuesday, SandRidge saw its share price increase by 69.4% to $1.83, which was a welcome boost after experiencing all-time lows throughout March.

Like the other two oil and gas penny stocks on the list, SandRidge didn’t release any news to garner the jump.

The company did, however, announce new leadership and several initiatives last week to help reduce low debt level, maximize free cash flow, preserve its strong balance sheet and liquidity position, and realize greater shareholder value.

Since the beginning of the year, SandRidge Energy has seen its share price drop 56.7%, so a shakeup was clearly needed.

Some of the initiatives include reducing costs and capital expenditures in 2020, deferring any material drilling and completion activity until commodity prices and the economics for new wells improve, and continuously evaluating the sale of non-cash flowing assets and other sale opportunities.

There hasn’t been any insider trading of SD stock to attribute to the high trading volume on Tuesday, which saw 4,597,479 shares trading hands.

If you are interested in oil and gas penny stocks, you might want to hold out to see if any exciting news comes from SandRidge Energy in the coming weeks and months, as well as where the overall industry is headed.

By 12 pm EST Wednesday, SD stock was down 11.5% to $1.62.

5 Oil and Gas Penny Stocks Surging: SilverBow Resources Inc. (NYSE:SBOW)

Houston-based energy company SilverBow Resources is another oil and gas penny stock that had a great day in the markets on April 21.

The typically thin-traded stock saw a trading volume of 583,184 shares on Tuesday, which sent the price up 42.9% to $3.80.

It’s encouraging to see an uptick in SBOW stock, considering the price is down over 63% since the beginning of the year.

>> 3 Retail Chains That Could Go Bankrupt Because of Coronavirus

On April 7, SilverBow announced that it has suspended drilling and completions activity until commodity prices warrant further investment and deferred completing and bringing online eight oil wells until at least the second half of 2020.

On top of that, the company is curtailing gas production in light of the extremely low commodity prices and reducing capital investments.

SilverBow is now providing guidance to a 2020 capital program of $80-$95 million, which represents a 55% reduction at the midpoint from the previous guidance.

One Wall Street analyst has offered SBOW a 12-month price target of $14, which represents a potential upside of 268.42%. Of course, that analyst also downgraded to a “hold” rating, which suggests now is likely not the best time to buy SBOW.

On Wednesday afternoon at 12:30 pm EST, SilverBow stock was up another 20.3% to $4.57.

5 Oil and Gas Penny Stocks Surging: Chesapeake Energy Corp. (NYSE:CHK)

Last but not least on the list of oil and gas penny stocks that saw sizeable gains on Tuesday is Chesapeake Energy, a shale oil and natural gas company with assets across the US.

It’s curious to see CHK in the green after an interesting week.

On April 13, Chesapeake announced a reverse stock split of its issued and outstanding common stock at a ratio ranging from 1-for-50 (1:50) to 1-for-200 (1:200), as well as a proposal to reduce the total number of authorized shares of the Company’s common stock.

Then, just days later, the debt-laden company announced that it has suspended dividend payments on each series of its outstanding convertible preferred stock with immediate effect.

The news caused Ladenburg Thalman & Co. analyst Michael Schmitz to downgrade the company’s rating from “hold” to “sell,” with a price target of $10 due to the “uncertainty over the duration and magnitude of the negative impact on the financial and commodity markets from the coronavirus.”

Like many other oil and gas penny stocks, it might be better to hold off on CHK stock until there is more clarity around the future of the market.

On Wednesday, Chesapeake Energy stock was up another 3% to $18.31, adding to the 30.95% increase seen on Tuesday.

Takeaway

It’s no secret that the oil and gas industry is experiencing unprecedented losses in the last few months due to the COVID-19 outbreak.

If anyone doubted the dire state of the industry, seeing West Texas Intermediate oil futures drop below $0 likely drove the point home.

The thing is, the current impact the coronavirus is having on the supply and demand chain won’t last forever. It’s unclear how long the pandemic will last, but it is encouraging to see countries like China and Denmark coming back online slowly.

Regardless of how long it takes, the demand for oil and gas will likely eventually return to normal once global economies get up and running again.

Until alternative energy takes over, there will always be demand for oil and gas, which is why it’s a good idea to add oil and gas penny stocks to your watchlist for when the market makes its rebound.

What are your thoughts on the future of the oil market? Share with us in the comments!

Featured Image: DepositPhotos © Kokhanchikov